Has the pharmaceutical industry discovered a cure for obesity?

The healthcare sector has always featured prominently within our clients’ discretionary portfolios, and we carefully monitor any new developments. With the highly publicised ‘anti-obesity’ drug featuring notably in the news, Stuart Dickson, Senior Investment Director, investigates and considers is there really a cure for obesity and could it provide an investment opportunity?

‘Miracle weight loss drug!’ sounds like one of those scams you see on social media. However, headlines about celebs from Elon Musk to Jeremy Clarkson dropping pounds due to a once-a-week injection, have catapulted the pharmaceutical industry into the headlines. After many false dawns, finally drug companies may have cracked the curse of obesity by creating drugs which actually work.

The increasing societal problems caused by obesity

Obesity – defined as an accumulation of fat on the body representing a risk to health – has been growing as a problem for society and healthcare providers for decades. What’s more, where once it was considered a problem only in high-income countries, it is now rising dramatically in low- and middle-income regions, especially in towns and cities and among younger people.

Why is this happening? While a fall in the price of calories is surely to be welcomed, this has largely been in the form of ultra-processed foods (UPFs) which often have addictive qualities and are relatively calorie dense. On the other side of the equation, society has become more sedentary, with the COVID-19 pandemic restrictions only exacerbating matters.

What is the impact of the growing problem of obesity?

Obesity is linked to 236 related conditions*, including everything from certain cancers to heart disease and sleep apnoea, and is becoming a huge issue for individuals and health care providers worldwide. Indeed, according to the World Health Organisation, as many as four million people are now dying annually from obesity related diseases and the estimated treatment costs, combined with lost economic revenue, may exceed US$4trn, or 3% of global Gross Domestic Product, by 2035**.

Government policies on nutrition and exercise will of course remain important, yet evidence suggests they work poorly in the medium- to long-term. Having helped to create the problem, capitalism seems to have only come up with one actual solution.

A ‘miracle drug’ emerges

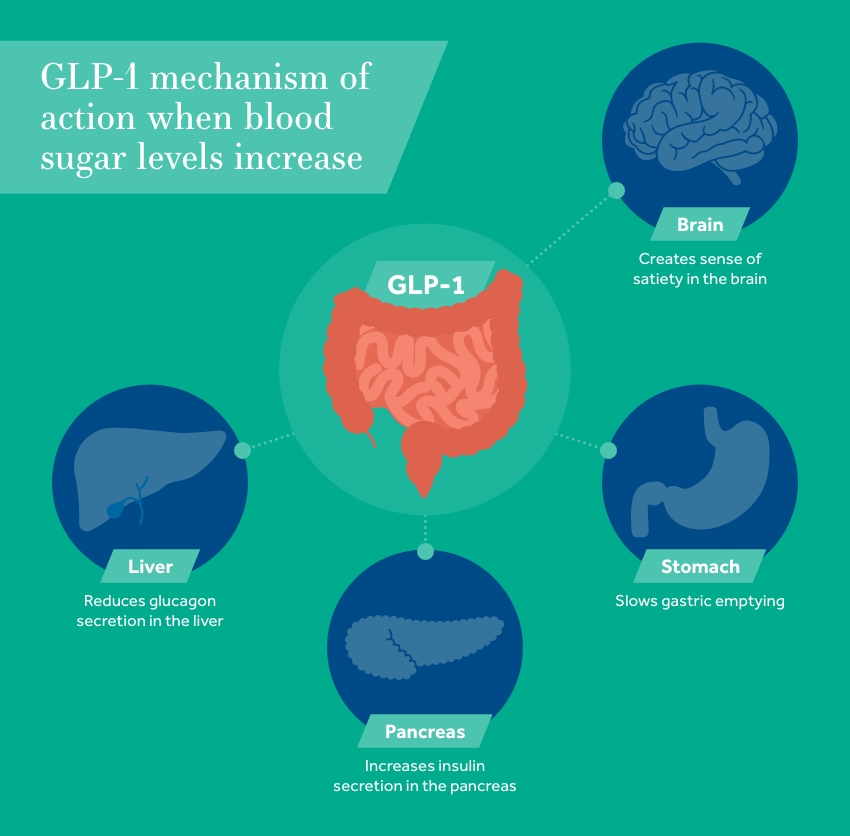

Like many pharmaceutical discoveries, such as Penicillin and Viagra, the discovery of these anti-obesity drugs was somewhat accidental. They were originally developed to help patients with Type-2 (or ‘adult onset’) diabetes. They mimic the action of a hormone called GLP-1 which you naturally release when you eat. For diabetics, they help control blood sugar levels after eating by prompting the body to produce more insulin. However, there was a noted side effect – weight simply disappeared from some of those taking the drug in trials as they no longer felt hungry. Trials on these drugs, specifically for obesity, suggest an average weight loss of 15% over two years when combined with diet and exercise.

How big is the potential investment market for these weight loss drugs?

The obesity drug market is currently shared between:

- Novo Nordisk’s Wegovy, which was approved in the US and UK earlier in 2023, and

- Eli Lilly’s Mounjaro which should hit the market officially by the end of 2023, but which has already seen considerable sales from doctors’ prescribing it ‘off label’ (before approval by the pharmaceutical regulators).

However, several other manufacturers have similar drugs in development, attracted by the potential size of the market.

How big is the market for these products? Based on findings at the end of June 2023, these drugs were only being used by a few hundred thousand people. However, the potential market is massive. Morgan Stanley recently estimated that 7% of all Americans - or 24 million people - could be taking them by 2035. If this pattern is repeated around the world, eventually they could reach 500 million people.

What changes are needed to unlock the market potential for obesity drugs?

Several things are necessary for this to happen:

- Companies need to launch oral versions – many potential patients are put off by the need for weekly injections – and indeed, these should be launched in the next couple of years

- While 15% weight loss is impressive, more is needed and the effectiveness could be improved - thankfully, the combination drugs on trial currently promise as much as 24%

- The costs need to come down – they currently cost as much as US$12K per person annually in the US; while this is much cheaper in other countries, it would represent a cost of US$288bn if 24 million Americans receive the drug, which may drain healthcare providers in the short- to medium-term

- Competition from new entrants and pill formulations will be cheaper to make than pre-filled syringes, and will help reduce prices and grow the market

- Finally, health providers, from US health insurers to our own NHS, need to be prepared to accept the seriousness of the condition and the role these drugs could play in reducing illnesses and mortality from related diseases such as heart attacks and strokes.

Regarding this last point, the drug companies are conducting large trials which hope to prove effectiveness in preventing diabetes and a whole range of other illnesses - indeed initial results are promising in reducing heart attacks and strokes.

More anti-obesity medications mean society will consume fewer calories. Potentially, this could mean severe long-term headwinds for food providers, especially those offering UPFs, snacks and drinks packed with sugar and fat. Ultimately medical device manufacturers could also be affected if there are fewer bariatric surgery procedures, heart devices, and even fewer artificial joints.

Are there any side-effects?

Are we being promised a miracle? It often pays to be wary of drugs which make headlines, especially when they mostly relate to the rich and famous trying to maintain their looks – and they do have side effects, such as nausea. And while these drugs can help users lose weight, for best and consistent results, they should still form part of a healthier and more active lifestyle.

Therefore, while cracking the curse of obesity and its side-effects remains a complex web of causes and potential solutions, society does at least now have a hugely powerful weapon in its armoury.

With the possibility of weight loss drugs becoming the ‘golden ticket’ for pharmaceutical companies, our Investment Managers will keep a watchful eye on share prices as they may offer the possibility for clients to benefit from future attractive investment returns.

*Source: Eli Lilly

**Source: World Obesity Federation report 2023, as quote in the BMJ

If you want to find out more, get in touch…

If you have any questions about anything raised in this article or about investment management more generally, please speak to your dedicated Investment Manager who will be happy to talk you through it.

If you are new to Adam & Company and would like to find out how our investment experts can help you build a diversified portfolio, request a free consultation.

You may also be interested in:

- Latest investment outlook

- Diversification in investing? Go global

- Take the long view: why staying invested is better than moving to cash

Need more help?

Whatever your needs, we can help by putting you in contact with the best expert to suit you.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Adam & Company makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Adam & Company is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Adam & Company is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.