Our investment outlook for April 2025

This article was written by Thomas Becket and originally published by Canaccord Wealth.

The latest outlook from our specialists on 2025’s key investment themes

In our latest investment outlook, Thomas Becket, Co-Chief Investment Officer, reviews the first quarter of 2025, the evolving economic and geo-political landscape, and why there is still a strong case for investor optimism amidst falling markets.

Theme 1: geopolitics, economics and monetary policy

‘Big wheels that keep on turning’

We live and invest in uncertain times – which won’t come as news to any of you.

At Canaccord Wealth, we like to describe the inconsistencies of geopolitics, economics and monetary policy as the ‘big wheels that keep on turning’. Those wheels sometimes rotate smoothly and in synchrony. At other times, they appear to crunch together, creating unpredictable jolts and friction. In the last few days it has felt as if the wheels are falling off altogether.

In the last twenty years we have seen financial crises, economic downturns, periods of political chaos in Europe, geopolitical angst and outright war, and now tariffs. We have also seen at least two significant equity bear markets and plenty of market corrections. However, during those two decades, investors have broadly been rewarded for making investments and sticking with them.

This is not to minimise the short-term volatility that grinding wheels can cause in financial markets. This can be worrying and unnerving for investors, but the long-term lesson learned is that it is a necessary part of any market cycle and can create opportunities.

In the current environment diversification and balance remain key and despite near-term turbulence, attractive opportunities are already emerging. By staying vigilant, and flexible, we are positioned to navigate uncertainty and capture emerging opportunities.

Theme 2: market and investment volatility

How do we avoid the potholes?

As we suspected, 2025 has been a year of high drama. We are well prepared for this volatility, which is reflected in our consistently balanced and diversified approach. We have braced ourselves for the skirmishes ahead and remember that the only real equation for future investment success is buying good investments at attractive valuations and holding them for a sensible period of time. Volatility across markets and in specific assets gives nimble investors an opportunity to fulfil this equation.

To say there is ‘a lot going on’ understates the oscillations that we are currently witnessing in geopolitics, politics, economics and financial markets: the early days, actions and intentions of the Trump administration are driving significant change.

Theme 3: global supply chain

Fragmentation – or just grinding the gears?

'Liberation Day’ tariffs confirmed our view that global supply chains are set to fragment further, with this trend likely to accelerate as countries reassess long-held trade policies and relationships. President Trump has made reversing the long-term decline of US manufacturing a central goal, and tariffs are his chosen lever to pursue it. He is right to highlight this issue, it has been a key source of economic and social discontent in the US and played a major role in his re-election.

However, these policies have unleashed a fresh wave of uncertainty. The strategy is clearly one of risk before reward, and risk assets like equities have had to reprice lower to offer higher risk premiums in a more uncertain environment.

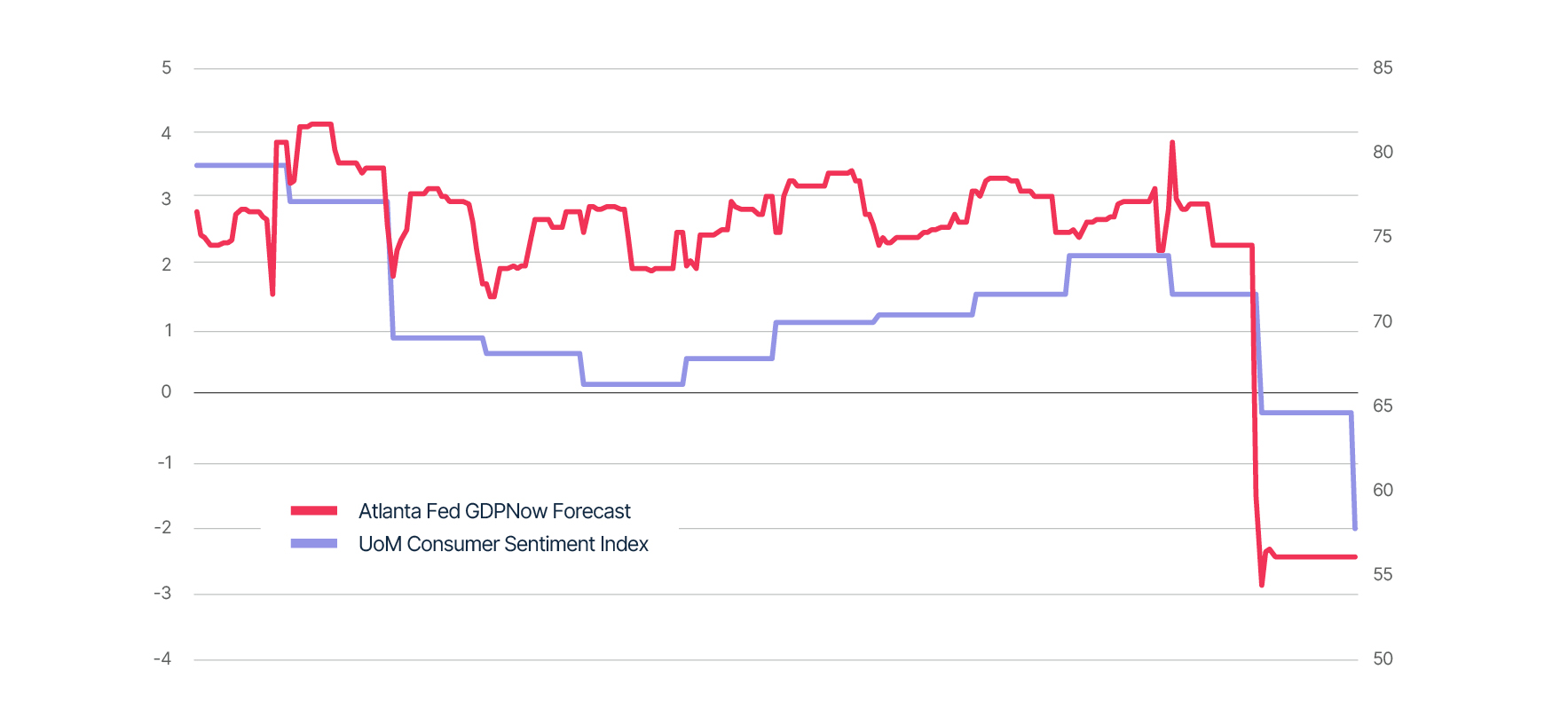

The unpredictability of Trump’s approach, even when following through on campaign promises, is contributing to a sense of economic unease at home. One of the key developments in early 2025 has been a slowdown in US economic activity (see fig. 1). While this has added to the market volatility we’ve seen this year, further evidence is required to see whether this will develop into a deeper or more lasting downturn. There are supportive economic policies expected later in the year which may help offset this initial weakness.

Fig 1 Noise or signal: start of a more pernicious economic slowdown in the US?

Source: Canaccord Wealth, Bloomberg – 01/04/2024 to 31/03/2025.

University of Michigan (UoM) Consumer Sentiment Index – a monthly survey measuring consumer confidence, a key economic indicator gauging consumer sentiment towards the economy and their financial situation.

The Atlanta Fed GDP Now forecast is a real-time model that provides an estimate of US GDP growth based on current economic data

Theme 4: European economy

Simultaneously, we are seeing a slightly better economic outlook in Europe, with plenty of fiscal support to come. We suspect that economic activity will remain low, but positive through the year, which should be sufficient to support asset markets.

There is also uncertainty over the path for inflation. Clearly, we are in a much better place than we were in 2022/23, but the disinflationary progress has stalled in recent months and there is some evidence that inflationary pressures are percolating in the global economy once more. Economic distortions, increased defence spending and trade tariffs drive inflation uncertainty, which we view as a key risk for later in 2025 and we have mitigated against such a risk in our portfolios.

Nonetheless, we still suspect that the major central banks globally will be inclined to cut interest rates further as 2025 progresses: we anticipate two rate cuts in both the UK and the US this year. However, much will depend on how the economic picture and inflationary pressures unfold.

Getting a head of steam – an economic boost

We might finally see some form of temporary ceasefire in Ukraine. A lasting peace would serve to cool the levels of tension globally. At the same time, the changing US-Europe relationship has forced European politicians out of their complacent slumber, spurring them to start increasing their defence spending. With the notable exception of Germany, there is no money available to ramp up this new required investment, so it will mean yet more debt, but it might provide a much needed and timely boost to the stagnant European economy.

2025: progress derailed, but not abandoned

Our view at the start of the year was that portfolios would make positive progress again in 2025, building on the recovery that started in Autumn 2022. This view came with an appreciation that the slow and steady path was precarious and that both inflationary flare-ups and growth disappointments could easily knock the recovery off course. Sweeping tariffs announced on ‘Liberation Day’ have done just that and caused a global rout in risk assets with global equities down -14.2% year-to-date at the time of writing (7 April).

Even so, some of our original expectations are playing out. Gains have started to broaden out geographically, away from the US and technology, with early signs of relative improvement in Europe and in more defensive sectors. As we anticipated fixed income has been a ballast in portfolios helping to offset volatility. The backdrop is no longer one of steady normalisation; it is now one of recalibration under a new, more uncertain regime. From uncertainty comes opportunity and the action we had taken in anticipation of such a scenario has given us confidence in our ability to capture such emergent opportunities.

Finding the right way forward

With everything we have discussed in this edition of Outlook, as well as all the subjects we couldn’t find space for, it is obvious that an investor’s path through 2025 is a step into ‘The Great Unknown’. At the same time, there is much to be optimistic about rather than just much to fear.

We urge against excessive swings in sentiment and pursue a pragmatic approach. As long as we can continue to find sound investments – at appropriate valuations – we will remain confident, rather than complacent, about the prospects of positive outcomes from portfolios. Despite all those ‘big wheels turning’ at the moment, this remains very much the case today.

Any questions?

If you have any questions about the current market and economic environment or your asset allocation within your portfolio, please get in touch with us.

For further information on any of the terms used in this article please see our glossary of investment terms.

The case for getting in the ring with UK equities

As we review the historic performance history of UK equities, we discuss why our client portfolios can still benefit from investing closer to home.

Discover our accompanying article to Investment Outlook April 2025.

You may also be interested in:

New to Adam & Company Wealth Management?

If you are interested in finding out what the latest investment outlook means for you, we can put you in touch with an expert that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Adam & Company makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Adam & Company is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Adam & Company is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.