Taking stock: Trump’s first 100 days

This article was written by Tom Hibbert and originally published by Canaccord Wealth.

Past precedence: presidential policy

During President Franklin D. Roosevelt’s first 100 days he enacted a torrent of executive orders and all 15 of his major legislative priorities were passed in US Congress, helping to bring about a sharp economic recovery from the depths of the Great Depression. He also put the wheels in motion to end the Prohibition era.

In fact, it was Roosevelt that first popularised the scrutiny of a president’s first 100 days. He signed 99 executive orders in that time. Trump signed 139. His ambitions arguably go further than Roosevelt’s – aiming to structurally reshape the political and economic landscape.

Made in America

At the heart of Trump’s agenda is a commitment to reindustrialise the US. In 2000, the US was the world’s manufacturing hub responsible for a quarter of global manufacturing. Today, China leads with around 30%, almost equal to the combined share of the US, Japan, Germany, Korea and Mexico.

Trump aims to reverse this trajectory, bringing manufacturing back to the US and tilting the economy in favour of blue-collar Americans. There are several other important motivations for this shift including balancing unsustainable trade deficits, for national security, to provide tax revenue, or simply because America has long endured ‘unfair’ trade terms.

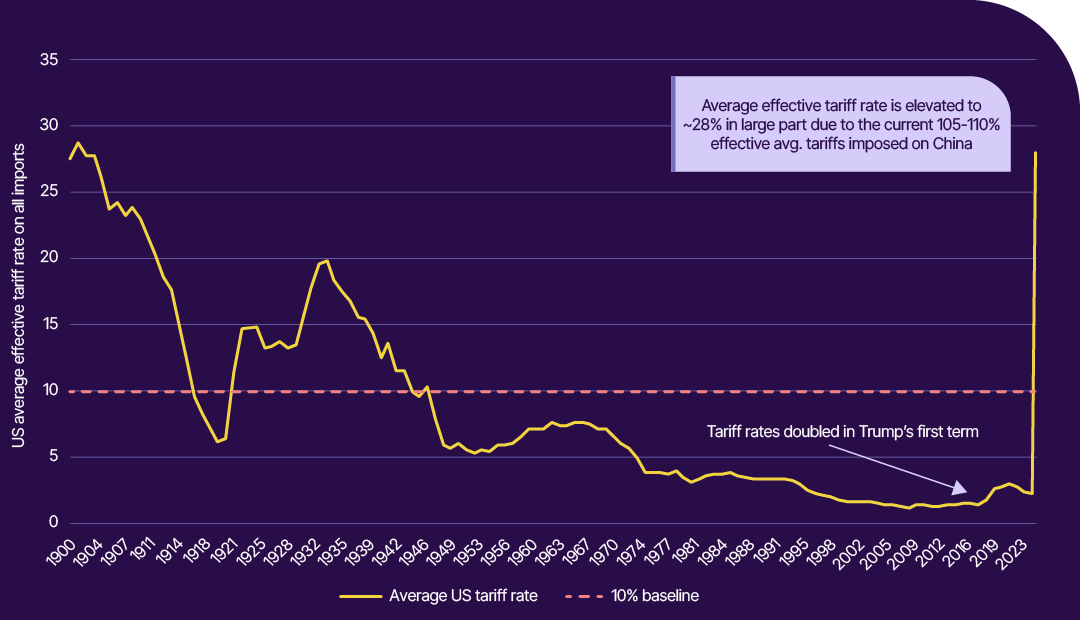

This philosophy underpins a renewed trade war which has sparked a lively debate around global supply chains and triggered a bout of volatility across financial markets with the US and tech bearing the brunt of the shock. The new order introduces a significant degree of uncertainty and although high tariffs and a push for economic self-sufficiency aren’t sustainable long-term, a potential constructive path forward lies in negotiation. If the US can shift from blunt-force tariffs towards a more targeted, negotiated form of industrial strategy the short-term costs could bring about a better future. For us the most likely outcome is a universal 10% tariff alongside more punitive rates applied more selectively particularly on China. Ultimately, economies thrive on cooperation, not isolation and markets need clarity and realism, or more directly, trade deals.

The graph below shows the average effective US tariff rate imposed on imports from the start of the 20th century to present day.

Fig 1: Average US tariff rate on imports up to Liberation Day

Source: The Budget Lab at Yale, Bloomberg.

The USD smile fades

The dollar’s recent weakness has caught the attention of global investors. Traditionally, the greenback strengthens either in times of market stress or when the US economy outperforms – the so-called ‘dollar smile.’ But since Trump’s policy pronouncements we’ve seen the smile fade, even turning into a frown: US equities have underperformed while the dollar has weakened, compounding losses for foreign investors.

Some of this reflects shifting views on US exceptionalism. Could the world be dipping into a US led recession? While hard data (economic statistics) remains firm, the soft data (surveys and sentiment) has taken a drastic turn for the worse, and market participants are reassessing whether the US can continue to outpace its peers in an increasingly multipolar world and amidst the US’ aggressive strategy.

Markets following Trump’s tariffs

US equities have taken a hit, particularly in tech, but there‘s a lot to be positive about, especially if trade tensions ease. Even increased competition with China and some form of reshoring the US could see an acceleration of technological innovation.

For bonds, yields may rise in the short term if the global economy remains resilient and trade policies reignite inflation, but a long-term de-escalation or economic slowdown should lead to lower yields.

Markets have stabilised following the post ‘Liberation Day’ correction and currently the embers of recovery are glowing.

While Trump’s second term is still in its infancy the message from markets is clear: they can adjust but the new strategy has increased uncertainty and the risks to inflation and growth have both increased. As investors, patience, perspective and protection through diversification will be key in how we manage client portfolios.

Any questions?

If you would like to discuss any of the themes raised in this article, in relation to the asset allocation within your portfolio, please get in touch with your usual Adam & Company account executive.

For further information on any of the terms used in this article please see our glossary of investment terms.

New to Adam & Company Wealth Management?

If you are interested in finding out what the latest investment outlook means for you, we can put you in touch with an expert that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance. The tax treatment of all investments depends upon individual circumstances and the levels and basis of taxation may change in the future. Investors should discuss their financial arrangements with their own tax adviser before investing.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.