What’s driving the green energy transition?

In the 18th century, when whale oil and candles were used for lighting, the trusty steed began to be replaced by steam engines for power and transport. This was one of the first energy transitions that changed how we produce and consume energy. Since the industrial revolution, the energy mix has evolved and now the move to green energy is under way.

The latest energy transition, from carbon-intensive sources to greener solutions, has primarily stemmed from the recognition of climate change and the impact it will have – better known as the ‘Attenborough effect’.

However, this energy shift has been compounded by more recent events – so what has reignited this?

What has compounded the transition to greener energy?

1. Rising prices

A surge in demand as economies recovered from the pandemic has seen crude oil prices rebound sharply, helping European oil majors post record profits. In addition, sanctions against Russia, a major supplier of oil and gas, have hurt supply – which has driven prices higher still. In the UK, the consumer energy price cap has reflected the change in wholesale energy prices with a 54% increase in April.

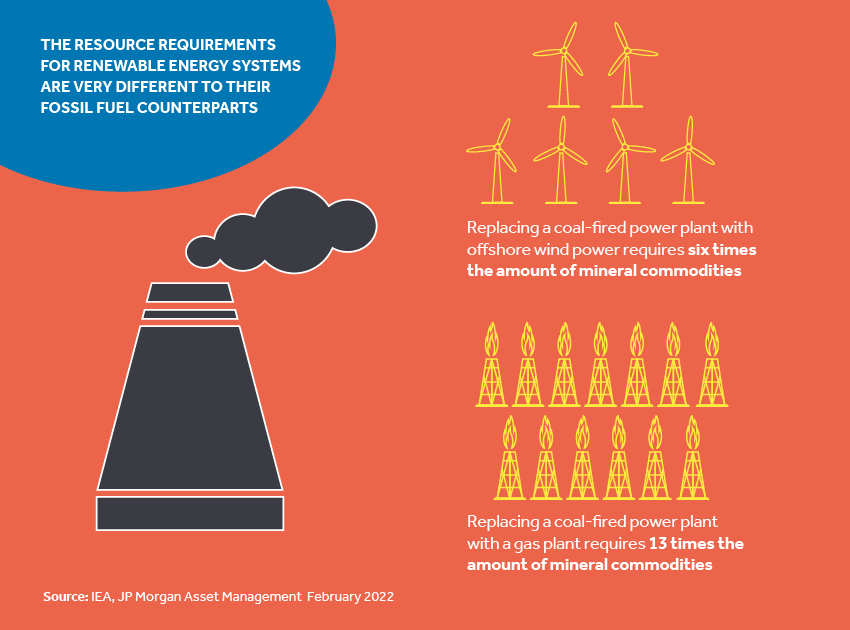

We have also seen higher mineral commodity prices. In particular, lithium, nickel, copper and cobalt have surged in response to an increased demand for battery production and the infrastructure needs of renewable energy. The resource requirements for renewable energy systems are very different to their fossil fuel counterparts: replacing a coal-fired power plant with offshore wind power requires six times as many mineral commodities, and for a gas plant it is 13 times more.

2. Underinvestment

Over the last five years, energy and mining companies have preferred to allocate profits to shareholders rather than invest in new projects, which have a high risk of regulatory scrutiny and public backlash. The implications of this underinvestment in future supply are profound and not easily undone. Mining developments have long lead times, often more than ten years. While markets may be adequately supplied in the short term, the lower projected number of mining developments could lead to supply shortages in the future. And if policymakers implement more stringent net zero targets, this could further exacerbate the long-term undersupply.

3. Uncertainty about supply sources

The tragic events in Ukraine have forced world leaders to acknowledge their dependency on imported energy. Many countries are evaluating their energy sources and considering the viability of onshoring their energy supplies. This is particularly problematic for mainland Europe, as many European countries heavily rely on Russian fuel imports.

Some energy sources, such as crude oil, have many suppliers and so can be replaced by an alternative supplier relatively easily. However, natural gas is less flexible as it is difficult to transport without a network of cross-continental pipelines. Uncertainty about future access to Russian gas will have implications for consumers, as well as European manufacturing, and is likely to speed up the energy transition to renewable energy sources.

The energy transition and renewables

In this latest energy transition, demands have shifted away from hydrocarbons towards renewables and electrification. Global energy markets will probably be restructured with a more diversified energy mix, leading to greater competition and more customer choice. The Department for Business, Energy & Industrial Strategy (BEIS) forecasts that renewables will power 40% of the UK electricity generation by 2030, as the use of coal dwindles and the next generation of UK nuclear power stations come online.

Green energy is the obvious solution for the recent energy crisis. Renewable energy has become more appealing thanks to falling costs and an improved ability to integrate high concentrations of variable power sources. In fact, the cost of building new wind and solar infrastructure is cheaper than the running costs of existing coal plants.

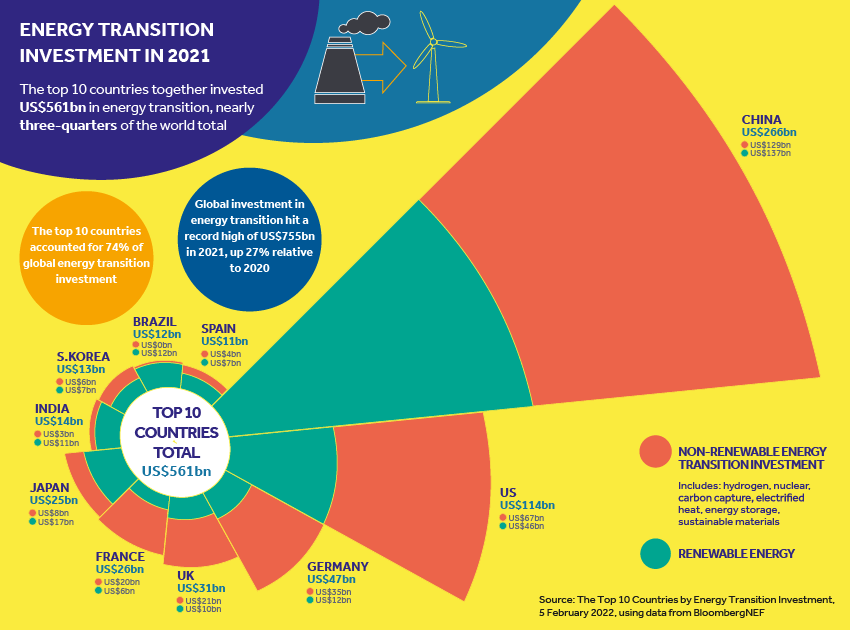

In 2021, US$755bn was invested into the global low-carbon energy transition, and this investment has increased by 27% since 2020. China represented 35% of the global energy transition investment, while the UK’s contribution was fourth highest, at 4% of the total spend. The investment was split across renewable energy (48%), electrified transport (36%) and other sectors including hydrogen, carbon capture and sustainable materials.

The United Nations Framework Convention on Climate Change (UNFCC) estimated that US$125trn in climate investment is required to achieve net zero on a global scale by 2050 (165 times the 2021 global investment).

Transition to sustainable energy is a race against time

It seems likely that a full transition to low-carbon fuels will occur; however, it may not be as quickly as the climate needs it to be, or necessarily lead to a proportional decline in fuel consumption. History shows us that energy transitions span decades, and that adding generation capacity in new fuel types will not facilitate a change by itself; coal required mines, canals, and railroads; oil required pipelines, wells, and refineries; electricity required generators and an intricate grid.

The latest energy crisis provides an opportunity for governments to kickstart the renewable energy transition and could be a game changer – for both consumers and the environment. The strong momentum behind green initiatives like electric vehicles is unlikely to stop any time soon, although production of these technologies may be hampered by the availability of mineral commodities. We can utilise lower carbon alternatives like nuclear and hydrogen to play a role alongside renewable energy as we make this necessary transition for the planet. The infrastructure will take time to develop, but the imperative is there and so are the ESG investment opportunities.

To find out more about the investment opportunities presented by the shift to greener energy, please request a complimentary consultation with an investment manager.

You may also be interested in:

If you want to find out more, get in touch...

If you want to find out more about wealth management and learn how this can benefit you, we can put you in touch with our team of experts that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Adam & Company makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. Adam & Company is not liable for the content and accuracy of the opinions and information provided by external contributors. All stated opinions and estimates in this article are subject to change without notice and Adam & Company is under no obligation to update the information.

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.