Corporate sustainability and sustainable investing – the way forward

Recent events have meant a great deal of change, with a lot of rebuilding to be done, and there are increasingly calls to rebuild in the ‘right’ way, with a stronger focus on equality, resilience, responsibility and environmental awareness, putting sustainability and sustainable investing at the core of the way ahead.

Sustainability is about making the right decisions today that will work and be for the benefit of the long term, so a full range of economic, environmental and social factors need to be considered. In terms of corporate sustainability, it is usually discussed in terms of Environmental, Social & Governance (ESG) credentials.

What is ESG?

In the 1990s a company that was seen to focus on ESG ran the risk of being viewed by investors and investment managers alike, as being distracted from the main business of making money. But since that time there’s been a complete turnaround in attitude and increasingly both companies and investors want to see adherence to ESG principles. Part of this is due to external requirements to act, with increasing government regulations and policies in this area:

- There was a focus on addressing the ‘G’ with the UK’s introduction of the Combined Code on Corporate Governance in 1998

- Standards on ‘S’ have been placed in the spotlight by the 2015 introduction of the UK Modern Slavery Act and gender pay gap reporting rules in 2017

- The ‘E’ is receiving ever more attention as the awareness of our impact on the environment grows, and global organisations such as the United Nations have been leading efforts to coordinate a response, with broad global support for the Paris Agreement in 2016, aimed at reducing greenhouse gas emissions, a key milestone.

How can investors measure ESG credentials?

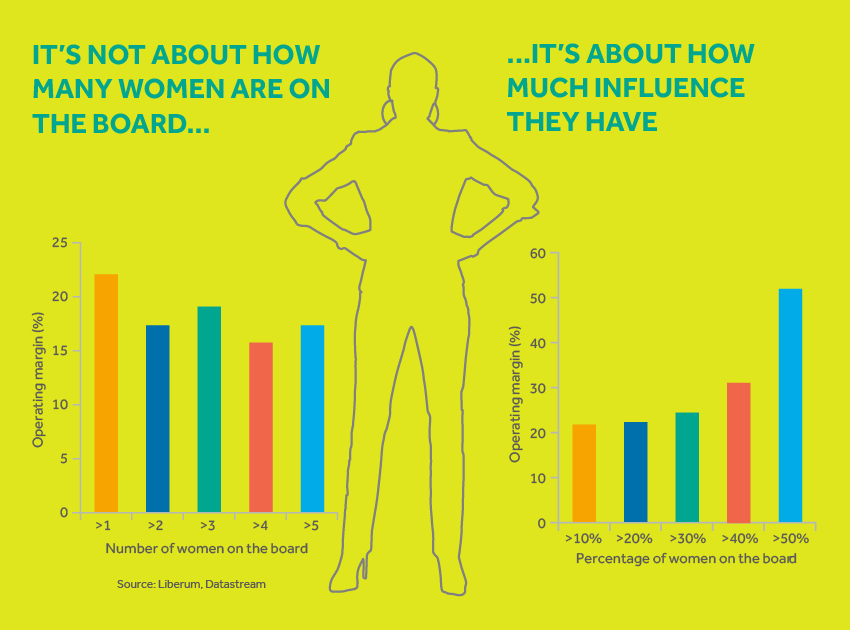

Research has shown there are sound reasons for companies to be good corporate citizens[1]. There are plenty of studies showing that companies who get corporate sustainability right outperform. A 2015 survey of more than 20,000 companies in 91 countries showed that a 10 percentage point increase in female representation on a board correlates with an increase of 0.7% in net profit margins. A joint UK/US study that compared companies measured as having a high regard to sustainability against those with a low regard, highlighted both a stock price and financial outperformance for the companies with strong corporate sustainability credentials.

Of course what’s being measured and how it’s interpreted by investors is one of the key problems at the moment. There are a wide variety of measurements and sources of information to choose from, many of which are difficult to standardise across companies, or indeed verify. Then there’s a question of how you combine the ‘E’, the ‘S’ and the ‘G’. How does a company that’s working on developing a very environmentally friendly product, but with some questionable corporate governance practices, rank against a company that has lower environmental credentials but is working on improving them and has the highest social and governance standards?

Our sustainable investment strategy

At Adam & Company we feel that sustainability, as defined by making the right choices for the long-term, dovetails with our focus on quality companies in structural growth areas. We’ve included our own ESG measures and analysis in our stock research since 2017 and we are looking to refine and deepen what we do.

On 21st March 2021 the EU Sustainable Finance Disclosure Regulation came into force, stipulating that all firms must have a policy on integration of sustainability risks into investment decision-making processes, which must be disclosed on the company’s websites.

Further to that, it asks companies to assess the principle adverse impacts of their investment decisions on sustainability factors and provides guidance on sustainability factors to be addressed. We plan to continue to make progress through developing our own internal processes and our engagements with companies.

Find this useful?

Read more about ESG here.

Speak to an investment manager about sustainable investing

If you’d like to know more about sustainability and ESG investing and the exciting opportunities they present, please get in touch with us or email enquiries@adamandcompany.co.uk.

New to Adam & Company Investment Management?

If you are new to wealth management and would like to learn how this can benefit you, we can put you in touch with our team of experts that can help.

Investment involves risk. The value of investments and the income from them can go down as well as up and you may not get back the amount originally invested. Past performance is not a reliable indicator of future performance.

Our portfolios are designed to work over a typical investment cycle of 7-10 years, so we recommend you stay invested for at least seven years.

The information provided is not to be treated as specific advice. It has no regard for the specific investment objectives, financial situation or needs of any specific person or entity.

This is not a recommendation to invest or disinvest in any of the companies, funds, themes or sectors mentioned. They are included for illustrative purposes only.

The information contained herein is based on materials and sources deemed to be reliable; however, Adam & Company makes no representation or warranty, either express or implied, to the accuracy, completeness or reliability of this information. All stated opinions and estimates in this document are subject to change without notice and Adam & Company is under no obligation to update the information.

[1] Blazovich, J.L. and Murphy Smith, L. (2011), "Ethical Corporate Citizenship: Does it Pay?", Jeffrey, C. (Ed.) Research on Professional Responsibility and Ethics in Accounting (Research on Professional Responsibility and Ethics in Accounting, Vol. 15), Emerald Group Publishing Limited, Bingley, pp. 127-163. https://doi.org/10.1108/S1574-0765(2011)0000015008

Find this information useful? Share it with others...

Investment involves risk and you may not get back what you invest. It’s not suitable for everyone.

Investment involves risk and is not suitable for everyone.